BCBS Compliance

In a Nutshell...

The ActiveViam FRTB Accelerator is designed and built to support the FRTB Standard Approach and Internal Models Approach as per the BCBS 352 specification.

For the Standardised Approach implementation, see BCBS Compliance - Standardised Approach .

For the Internal Models Approach implementation, see BCBS Compliance - Internal Models Approach .

Standardised Approach Calculations

For unapproved desks, the Standardised Approach is used to calculate the SA Capital Charge.

This involves the aggregation of:

- Sensitivities Based Method (SBM) Capital Charge

- Standardised Approach Default Risk Charge (SA DRC)

- Residual Risk Add-On (RRAO)

So, for the Standardised Approach, the Capital Charge is defined as the sum of three entities, as shown in the following graphic:

Internal Models Approach Calculations

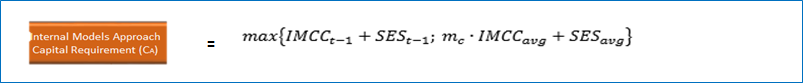

Firstly, the Capital Requirement (CA) for approved desks must be calculated. This is computed using the formula shown below, involving IMCC (the Internally Modelled Capital Charge) and SES (the Stressed Capital Add-On):

Where 't-1' means 'the previous day's value for.....' and 'mc' is 'a multiplication factor, which will be 1.5, or a value set by individual supervisory authorities' and 'avg' means 'the average over the last 60 days'.

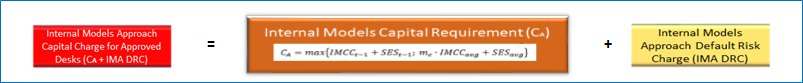

For approved desks, the Internal Models Approach is used to calculate the IMA Capital Risk Charge. This is computed by adding the following two measures:

- Capital Requirement (CA) for approved desks (see above)

- Internal Models Approach Default Risk Charge (IMA DRC)

So the IMA Capital Charge is defined as the sum of two entities, as follows:

Integrating Desks across the two approaches

It is possible to integrate desks across the two approaches.

Desks are recognised as a node in the book hierarchy. If a node is specified to be a desk, it must be specified if it is an SA or an IMA desk.

The Combined Capital Charge is computed across all desks contributing to the approved capital () and unapproved capital (

).

Combined Calculations

The aggregate capital charge for market risk (ACC) is equal to the aggregate capital requirement for eligible trading desks plus the standardised capital charge for risks from unapproved trading desks.

Within ActiveViam's FRTB Accelerator, the Aggregate Capital Charge (ACC) is referred to as the Combined Capital Charge (CCC).

So the Combined Capital Charge is defined as the sum of two entities, as follows:

FRTB Accelerator Measures

Aggregation logic is provided, which implements the SA and IMA aggregations rules as outlined in BCBS 352. Full reconciliation is possible, as every step of the calculation is represented by a measure that can be visualised in a pivot table (or tabular view) of the cube.

For more information see Working with measures

Copyright © 2019 ActiveViam Ltd. All rights reserved.